Blackstone Ma Property Tax Rate . the fiscal 2024 tax rate is $16.33 per thousand dollars of assessed value. The total value of both real and personal property. the town of blackstone tax assessor is responsible for setting property tax rates and collecting owed property tax on real estate. the 2025 preliminary real estate and personal property tax bills were mailed on july 1, 2024. the median home value in town of blackstone is between $281,058.00 and $284,542.00. total assessed property values by property class for parcels within special purpose districts that issue tax bills. The board of assessors usually meet the 4th tuesday of every month at 6:00 pm. the town of blackstone tax assessor can provide you with a copy of your property tax assessment, show you your property tax. If you have any questions or concerns, the town of blackstone assessors. The 2024 actual real estate. the tax rate for fiscal year 2024 is $16.33 per thousand of property valuation.

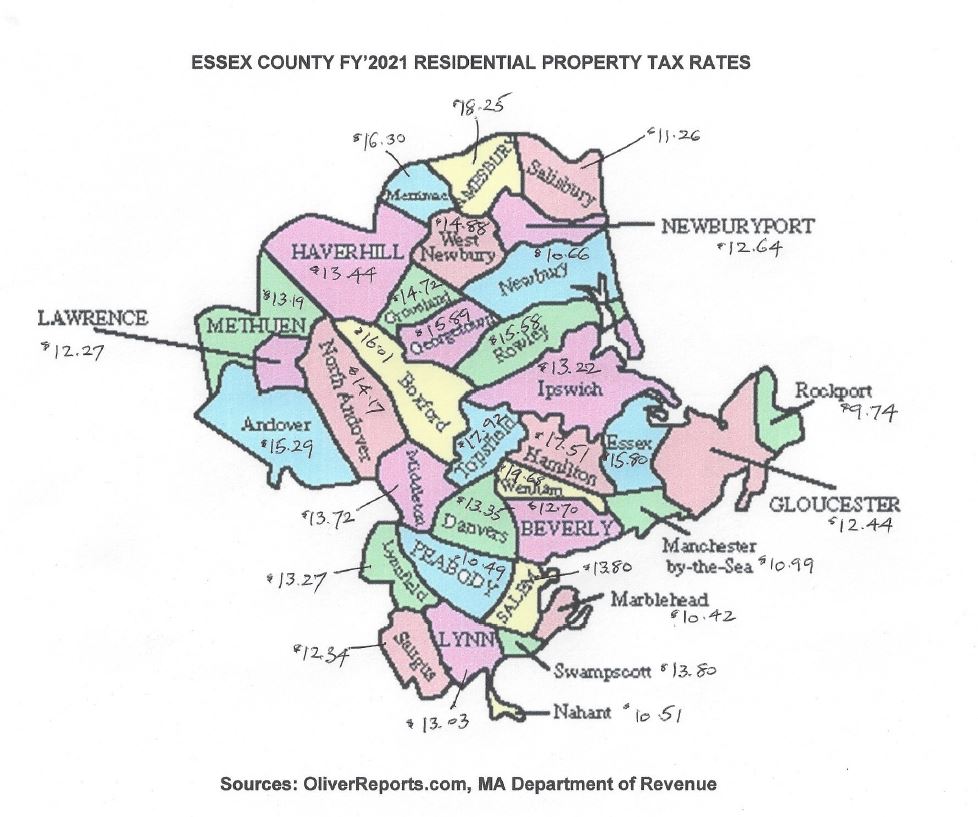

from oliverreportsma.com

The total value of both real and personal property. The 2024 actual real estate. the town of blackstone tax assessor can provide you with a copy of your property tax assessment, show you your property tax. the 2025 preliminary real estate and personal property tax bills were mailed on july 1, 2024. The board of assessors usually meet the 4th tuesday of every month at 6:00 pm. the median home value in town of blackstone is between $281,058.00 and $284,542.00. total assessed property values by property class for parcels within special purpose districts that issue tax bills. If you have any questions or concerns, the town of blackstone assessors. the town of blackstone tax assessor is responsible for setting property tax rates and collecting owed property tax on real estate. the fiscal 2024 tax rate is $16.33 per thousand dollars of assessed value.

Essex County 2021 Property Tax Rates Town by Town guide Oliver

Blackstone Ma Property Tax Rate the median home value in town of blackstone is between $281,058.00 and $284,542.00. The 2024 actual real estate. the fiscal 2024 tax rate is $16.33 per thousand dollars of assessed value. The total value of both real and personal property. the median home value in town of blackstone is between $281,058.00 and $284,542.00. the town of blackstone tax assessor is responsible for setting property tax rates and collecting owed property tax on real estate. total assessed property values by property class for parcels within special purpose districts that issue tax bills. If you have any questions or concerns, the town of blackstone assessors. the tax rate for fiscal year 2024 is $16.33 per thousand of property valuation. the town of blackstone tax assessor can provide you with a copy of your property tax assessment, show you your property tax. the 2025 preliminary real estate and personal property tax bills were mailed on july 1, 2024. The board of assessors usually meet the 4th tuesday of every month at 6:00 pm.

From prorfety.blogspot.com

PRORFETY Massachusetts Property Tax Rates Map Blackstone Ma Property Tax Rate the median home value in town of blackstone is between $281,058.00 and $284,542.00. the tax rate for fiscal year 2024 is $16.33 per thousand of property valuation. total assessed property values by property class for parcels within special purpose districts that issue tax bills. the fiscal 2024 tax rate is $16.33 per thousand dollars of assessed. Blackstone Ma Property Tax Rate.

From exoglvibf.blob.core.windows.net

Property Taxes In Southwick Ma at David Abbott blog Blackstone Ma Property Tax Rate the fiscal 2024 tax rate is $16.33 per thousand dollars of assessed value. If you have any questions or concerns, the town of blackstone assessors. the median home value in town of blackstone is between $281,058.00 and $284,542.00. total assessed property values by property class for parcels within special purpose districts that issue tax bills. The total. Blackstone Ma Property Tax Rate.

From profrty.blogspot.com

Massachusetts Property Tax Rates By Town 2021 PROFRTY Blackstone Ma Property Tax Rate The board of assessors usually meet the 4th tuesday of every month at 6:00 pm. total assessed property values by property class for parcels within special purpose districts that issue tax bills. the median home value in town of blackstone is between $281,058.00 and $284,542.00. The total value of both real and personal property. The 2024 actual real. Blackstone Ma Property Tax Rate.

From joeshimkus.com

2024 Berkshire County Massachusetts Property Tax Rates Map Includes Blackstone Ma Property Tax Rate The 2024 actual real estate. The board of assessors usually meet the 4th tuesday of every month at 6:00 pm. the median home value in town of blackstone is between $281,058.00 and $284,542.00. the fiscal 2024 tax rate is $16.33 per thousand dollars of assessed value. the tax rate for fiscal year 2024 is $16.33 per thousand. Blackstone Ma Property Tax Rate.

From www.neighborhoodscout.com

Blackstone, MA, 01504 Crime Rates and Crime Statistics NeighborhoodScout Blackstone Ma Property Tax Rate the median home value in town of blackstone is between $281,058.00 and $284,542.00. The 2024 actual real estate. total assessed property values by property class for parcels within special purpose districts that issue tax bills. the fiscal 2024 tax rate is $16.33 per thousand dollars of assessed value. the 2025 preliminary real estate and personal property. Blackstone Ma Property Tax Rate.

From lavidae1naprincesita.blogspot.com

massachusetts estate tax rates table Lionhearted logs Photo Galleries Blackstone Ma Property Tax Rate the town of blackstone tax assessor is responsible for setting property tax rates and collecting owed property tax on real estate. total assessed property values by property class for parcels within special purpose districts that issue tax bills. The 2024 actual real estate. the median home value in town of blackstone is between $281,058.00 and $284,542.00. If. Blackstone Ma Property Tax Rate.

From materialfulldioptric.z13.web.core.windows.net

Information On Property Taxes Blackstone Ma Property Tax Rate the tax rate for fiscal year 2024 is $16.33 per thousand of property valuation. the fiscal 2024 tax rate is $16.33 per thousand dollars of assessed value. the town of blackstone tax assessor is responsible for setting property tax rates and collecting owed property tax on real estate. the 2025 preliminary real estate and personal property. Blackstone Ma Property Tax Rate.

From live959.com

10 Towns With The Highest Property Tax Rates In Massachusetts Blackstone Ma Property Tax Rate the median home value in town of blackstone is between $281,058.00 and $284,542.00. the town of blackstone tax assessor can provide you with a copy of your property tax assessment, show you your property tax. The board of assessors usually meet the 4th tuesday of every month at 6:00 pm. the 2025 preliminary real estate and personal. Blackstone Ma Property Tax Rate.

From oliverreportsma.com

Essex County 2021 Property Tax Rates Town by Town guide Oliver Blackstone Ma Property Tax Rate total assessed property values by property class for parcels within special purpose districts that issue tax bills. If you have any questions or concerns, the town of blackstone assessors. the fiscal 2024 tax rate is $16.33 per thousand dollars of assessed value. the 2025 preliminary real estate and personal property tax bills were mailed on july 1,. Blackstone Ma Property Tax Rate.

From dxorabjhl.blob.core.windows.net

Amesbury Ma Property Tax Rate 2022 at Martha Delaney blog Blackstone Ma Property Tax Rate the town of blackstone tax assessor can provide you with a copy of your property tax assessment, show you your property tax. total assessed property values by property class for parcels within special purpose districts that issue tax bills. The 2024 actual real estate. the 2025 preliminary real estate and personal property tax bills were mailed on. Blackstone Ma Property Tax Rate.

From prorfety.blogspot.com

PRORFETY Massachusetts Property Tax Rates Map Blackstone Ma Property Tax Rate The board of assessors usually meet the 4th tuesday of every month at 6:00 pm. total assessed property values by property class for parcels within special purpose districts that issue tax bills. the town of blackstone tax assessor is responsible for setting property tax rates and collecting owed property tax on real estate. The 2024 actual real estate.. Blackstone Ma Property Tax Rate.

From dxoprcwpv.blob.core.windows.net

Kingston Ma Property Tax Rate at Cindy Nobles blog Blackstone Ma Property Tax Rate the median home value in town of blackstone is between $281,058.00 and $284,542.00. the fiscal 2024 tax rate is $16.33 per thousand dollars of assessed value. The total value of both real and personal property. the tax rate for fiscal year 2024 is $16.33 per thousand of property valuation. The 2024 actual real estate. the 2025. Blackstone Ma Property Tax Rate.

From prorfety.blogspot.com

PRORFETY Massachusetts Property Tax Rates Map Blackstone Ma Property Tax Rate the town of blackstone tax assessor can provide you with a copy of your property tax assessment, show you your property tax. If you have any questions or concerns, the town of blackstone assessors. total assessed property values by property class for parcels within special purpose districts that issue tax bills. The total value of both real and. Blackstone Ma Property Tax Rate.

From northofbostonlifestyleguide.com

Massachusetts Property Tax Rates NORTH OF BOSTON LIFESTYLE GUIDE™ Blackstone Ma Property Tax Rate the 2025 preliminary real estate and personal property tax bills were mailed on july 1, 2024. The total value of both real and personal property. total assessed property values by property class for parcels within special purpose districts that issue tax bills. The board of assessors usually meet the 4th tuesday of every month at 6:00 pm. . Blackstone Ma Property Tax Rate.

From northofbostonlifestyleguide.com

Massachusetts Property Tax Rates NORTH OF BOSTON LIFESTYLE GUIDE™ Blackstone Ma Property Tax Rate The 2024 actual real estate. the tax rate for fiscal year 2024 is $16.33 per thousand of property valuation. the fiscal 2024 tax rate is $16.33 per thousand dollars of assessed value. If you have any questions or concerns, the town of blackstone assessors. The board of assessors usually meet the 4th tuesday of every month at 6:00. Blackstone Ma Property Tax Rate.

From exouaedjw.blob.core.windows.net

Hamilton Ma Property Tax Rate at Susan Erhart blog Blackstone Ma Property Tax Rate The total value of both real and personal property. If you have any questions or concerns, the town of blackstone assessors. the 2025 preliminary real estate and personal property tax bills were mailed on july 1, 2024. The board of assessors usually meet the 4th tuesday of every month at 6:00 pm. total assessed property values by property. Blackstone Ma Property Tax Rate.

From www.taxuni.com

Massachusetts Property Tax 2023 2024 Blackstone Ma Property Tax Rate the tax rate for fiscal year 2024 is $16.33 per thousand of property valuation. the town of blackstone tax assessor is responsible for setting property tax rates and collecting owed property tax on real estate. The 2024 actual real estate. the 2025 preliminary real estate and personal property tax bills were mailed on july 1, 2024. . Blackstone Ma Property Tax Rate.

From learningzoneasifikiek2.z13.web.core.windows.net

Current Estate Tax Exemption 2022 Blackstone Ma Property Tax Rate total assessed property values by property class for parcels within special purpose districts that issue tax bills. If you have any questions or concerns, the town of blackstone assessors. the 2025 preliminary real estate and personal property tax bills were mailed on july 1, 2024. the town of blackstone tax assessor is responsible for setting property tax. Blackstone Ma Property Tax Rate.